Reduce Risk, Increase Returns, Maximize Control

zTreasury™ seamlessly consolidates banking, brokerage, and counterparties on a secure, unified platform.

Discover a revolutionary SaaS-based Treasury, Liquidity, and Portfolio Finance system designed exclusively for investment managers and Hedge Funds.

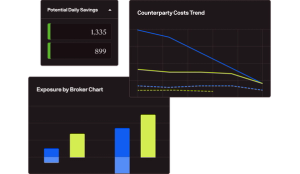

Utilize a better way to manage your cash, credit facilities, liquidity, legal entities, and investor notices.

Seamlessly consolidate banking, brokerage, and counterparties on a secure, unified platform.

Learn More

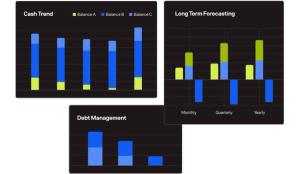

Utilize sophisticated algorithms for just-in-time execution, model bank credit facilities confidently, and streamline capital lifecycle management.

Learn More

Control, monitor, reconcile, and benchmark your counterparty and custodian-related operations.

Learn More

Unparalleled insights into market rates for hedge funds and other alternative asset managers interested in market structure and trends.

Learn More

Normalized, consolidated, and enhanced data across multiple banks and counterparties in one easy-to-use, centralized platform.

Learn More

Optimize your returns by efficiently sweeping excess cash into money market funds.

Learn More